Taxation is a mind-boggling subject. It is not easy to comprehend complex clauses of taxes, especially as a layperson with no accountancy or finance background. Understanding the basics of taxation is important because it allows you to navigate your legal obligations as a taxpayer. To avoid mistakes and errors, as a taxpayer, everyone should understand how taxation works and why we have to pay certain taxes?

Numerous studies reveal that tax knowledge is directly proportional to tax compliance. The more tax knowledge you have, the higher the degree of tax compliance you are likely to profess. Motor vehicle tax is one of the many categories of taxes that we are legally obliged to pay as a citizen of Pakistan. The Excise and Taxation Department of Pakistan levies motor vehicle taxes. Motor vehicle taxation is a provincial levy, and it may differ for each province of Pakistan. This tax is administered under the acts of Motor Vehicle Ordinance 1965 and Motor Vehicle Tax, 1958. Every private and commercial vehicle owner has to pay motor vehicle taxes.

In Pakistan, the automobile industry is the largest taxpayer. The motor vehicle tax accounts for 40% of the retail value of the car. The 40% of motor vehicle tax substitutes 7 different types of taxes. But what are these 7 taxes, and why do we pay them? Here is an overview of 7 different types of motor vehicle taxes that every vehicle owner should know.

1. Token Tax

As the name suggests, token certifies that your car is eligible to use roads. Token tax is paid to the provincial government, which provides the vehicle owner with the payment receipt and a sticker as a token to display on the vehicle’s windshield. Failure to display this sticker can result in penalization. The rate of token tax depends upon the engine capacity of the vehicle. Token tax is paid annually. For vehicles below 1000c, token tax is paid only once at the time of registration.

2. Income Tax

Vehicles qualify as movable assets that signify economic value. This makes a vehicle taxable and therefore subject to income tax. As a vehicle owner, you have to pay a certain amount of income tax on your vehicle. The rate of income tax on the vehicle is paid annually, per seat of the vehicle.

3. Professional Tax

By definition, professional tax is based upon the profession and employment type of the vehicle owner. Formerly, the rate of professional tax varied according to the profession. However, the Punjab Government has now set the amount of professional tax Rs. 200 for vehicle owners under all different professional categories.

4. Withholding Tax

Withholding tax is charged to register the vehicle as your ownership. Withholding tax is applicable both at the time of registration of a new vehicle and transfer of ownership of a used vehicle. The rate of withholding tax is different for new registration and transfer of ownership. Withholding tax varies as per the engine capacity of the vehicle.

If you are getting the vehicle on lease, the respective financial institute will collect the withholding tax from you. The payable withholding tax is reduced by 10% annually starting from the time of first registration.

5. Motor Tax

Motor tax is charged for both commercial and passenger vehicles. For commercial vehicles (such as trucks, trailers, vans), the motor tax rate depends upon its loading capacity. On the other hand, the rate of motor tax for passenger vehicles depends on the engine and seating capacity.

6. Import tax

As the name indicates, import tax is levied on the import of vehicles. This tax is charged under two regimes. Normal regime import tax depends upon engine capacity and value of the vehicle. Special regime import tax depends upon engine capacity only irrespective of other accessories or value of the car. Import tax is also known as customs duty and import tariff.

7. Luxury tax

The luxury tax is levied on high-end imported vehicles. By definition, a high-end vehicle implies any vehicle above the engine capacity of 1300cc.

All these 7 types of taxes are added up to the ex-factory price of vehicles, constituting the retail price. Even in the case of locally manufactured cars, most of the raw materials are imported which leads to a price surge. The price hike of vehicles is a result of these taxes. Every vehicle owner needs to understand these basic facts about motor vehicle taxation to stay updated about its implications.

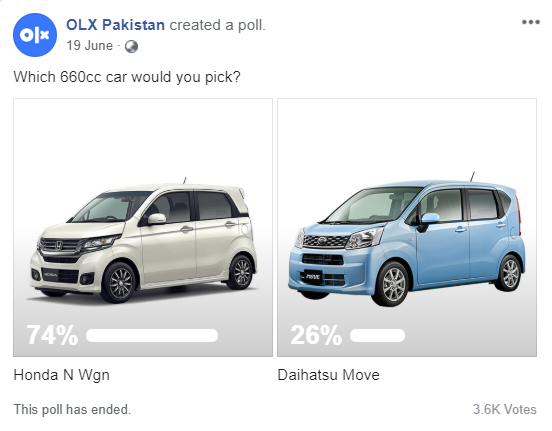

If you are looking into buying or selling a car or any other vehicle, visit OLX Pakistan to find a wide range of vehicles and choose the one that best suits your preferences and budget.

You may also like:

Leave a Reply