If you are purchasing a non PTA mobile, or coming back from abroad with a mobile, getting it approved from PTA is necessary to use sim services in Pakistan. This ensures your device is registered, which further prevents penalties. To make the PTA tax payment convenient, there is an online system available through the DIRBS portal on the PTA’s official website. Let’s have a look at how to pay PTA tax online in the blog.

Understanding a PTA Tax in Pakistan

PTA Taxes are mandatory charges for mobile phones to enable mobile network services. This amount is not fixed and varies depending on the device; for instance, flagships or newly launched mobile phones, such as the iPhone 17, will have higher taxes. PTA-approval is mandatory to prevent SIM blockages and getting penalized.

What is the DIRBS System?

The DIRBS system, also known as the Device Identification, Registration, and Blocking System, was introduced by the Pakistan Telecommunication Authority (PTA). It is responsible for identifying illegal or smuggled devices and blocking them, ensuring all the devices are compliant with the PTA by paying PTA taxes.

How To Pay PTA Tax Online in Pakistan?

The following is how you can pay PTA Taxes online in Pakistan:

- The first is to know your IMEI number. Dial *#06# from the dial pad of your device, and it will show your 15-digit IMEI number.

- To pay the PTA tax online, go to the official website of the PTA.

- Click on the Mobile Registration (DIRBS).

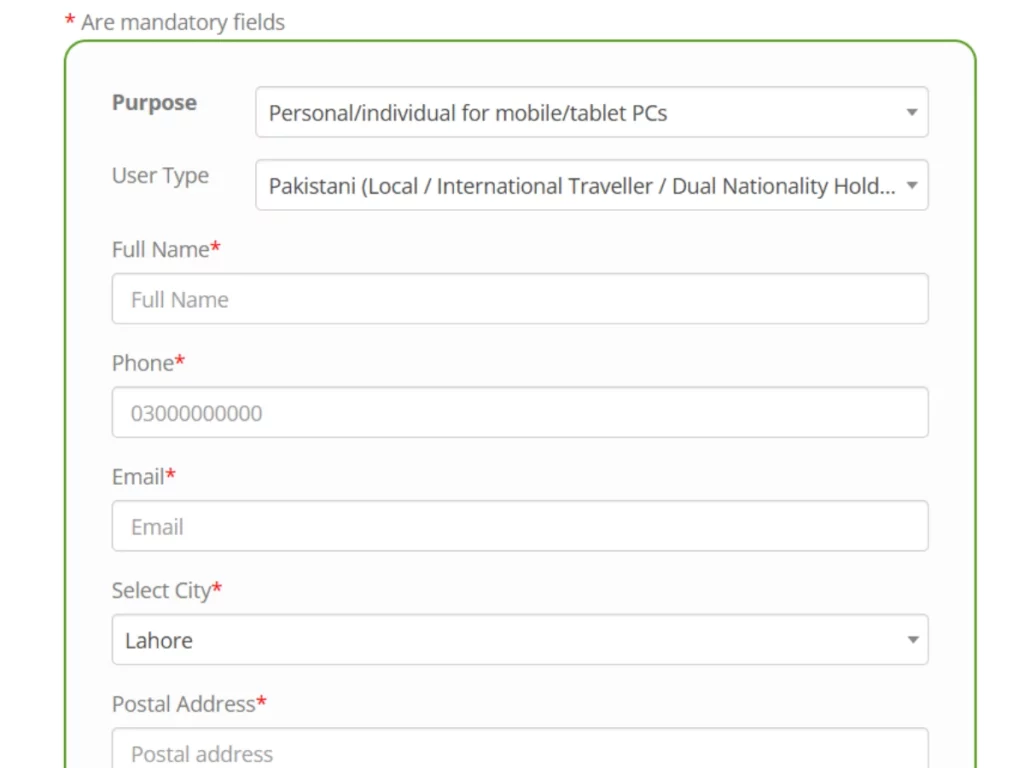

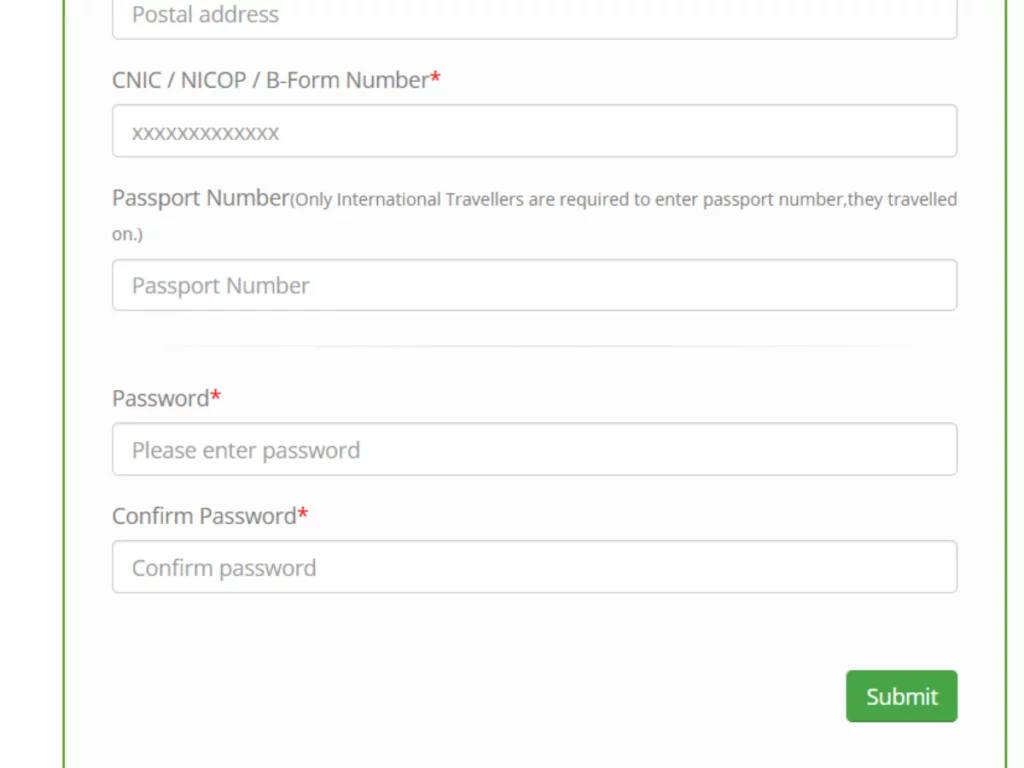

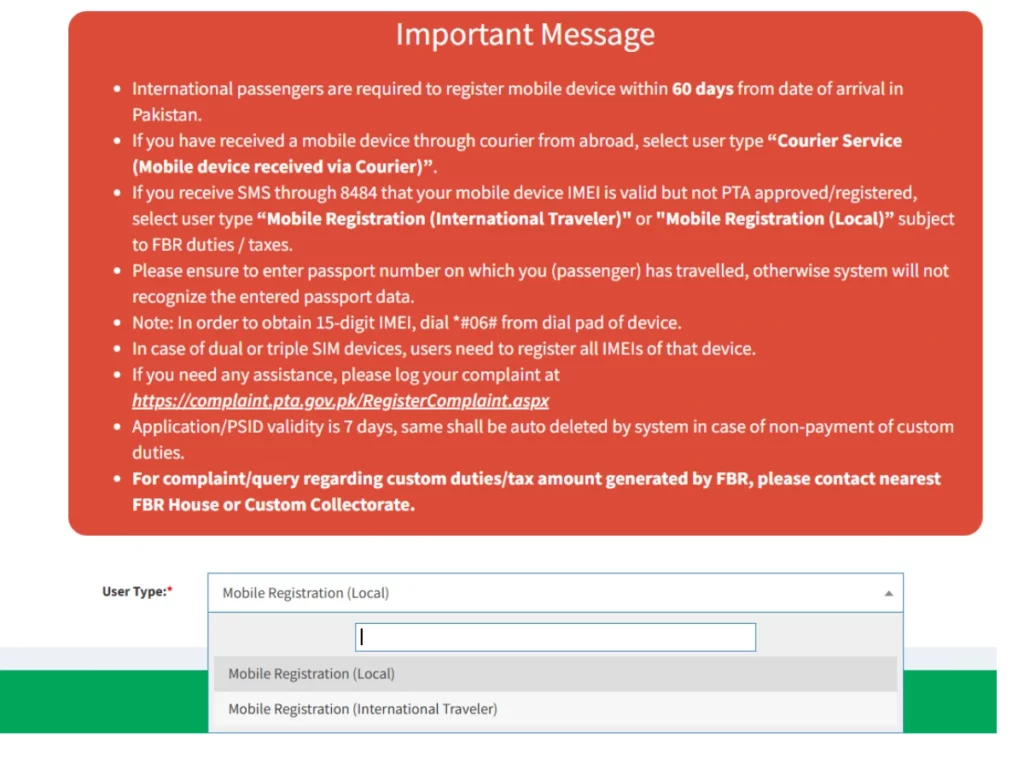

- After this, you will have to sign up for your account by selecting the suitable options for the purpose and user type. Once you fill out the registration form with all the correct information, click on the submit button.

- If you are already registered, you can skip this step and simply log in to your account.

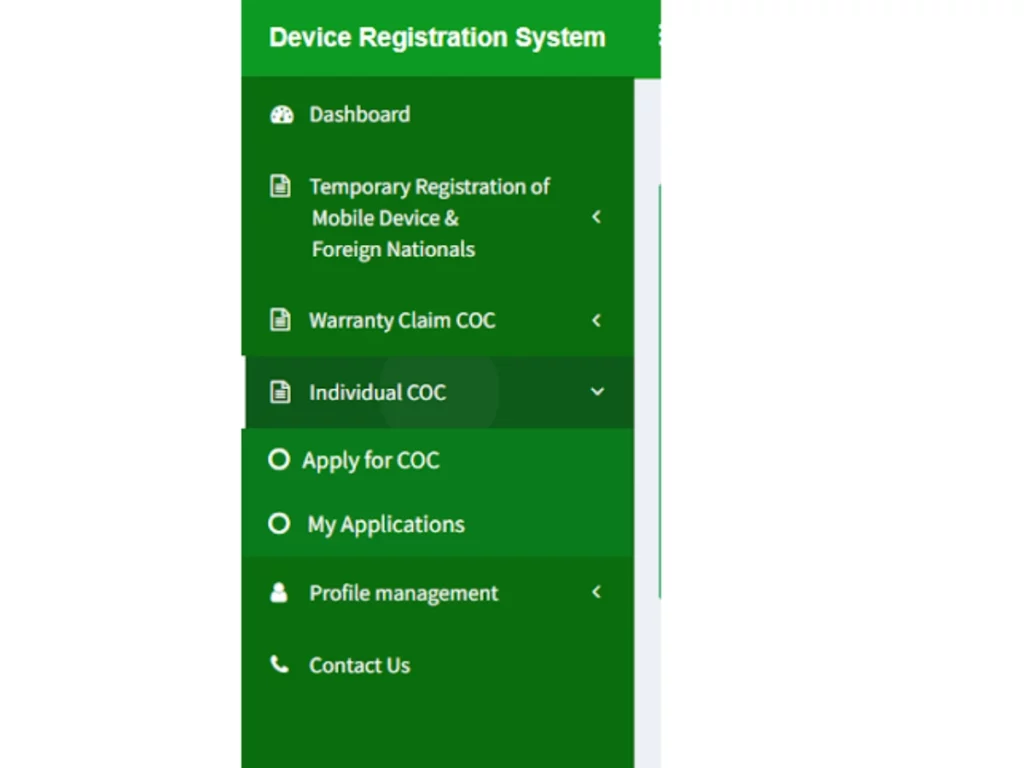

- Click on the Individual COC option on the left side and then on the Apply for COC option.

- After this step, the website will direct you to the Application for Certificate of Compliance of Sets, Tablets & TE.

- Select the user type, either local or international traveler (pta taxes on passport are lower).

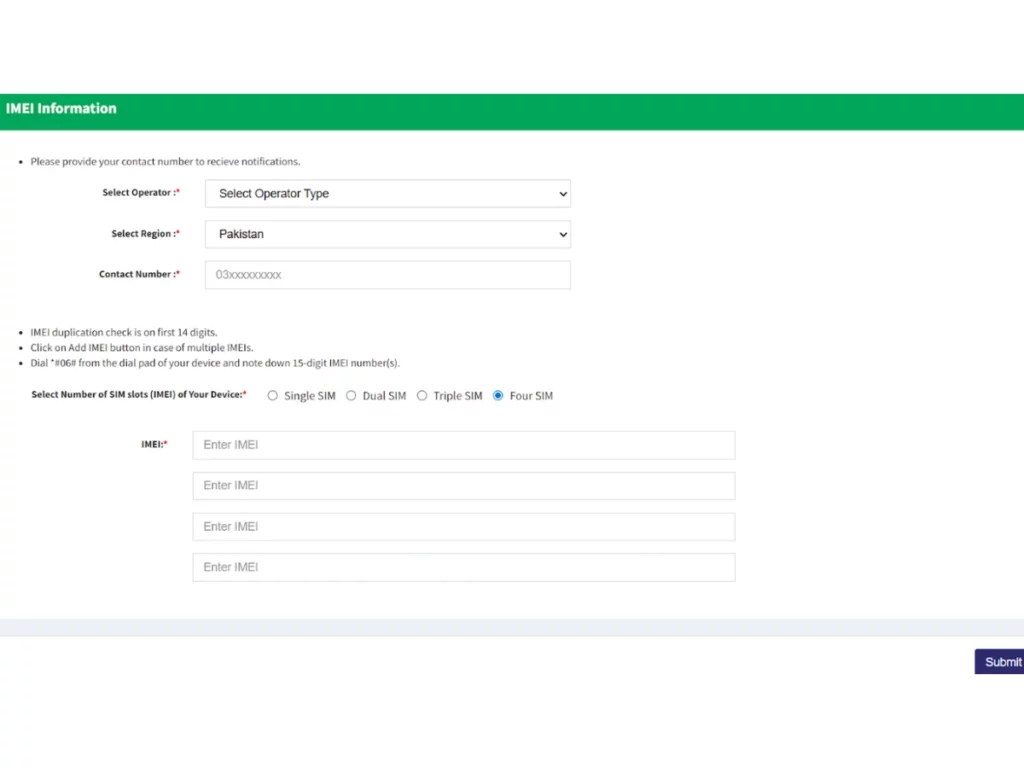

- After this, scroll down and put all the correct IMEI information, which includes operator, region, contact number, and SIM slots of your device (single, dual, triple, or four).

- Once done, click on the submit button at the bottom right corner.

- It will create a 17-digit PSID for the PTA tax payment along with the customs payment amount.

- With the help of this PSID, you can pay PTA tax at all the bank branches, online banking, ATMs, and mobile banking.

How To Check if Your Device is PTA Approved?

The following is a step-by-step procedure to see if your device is PTA-approved or not:

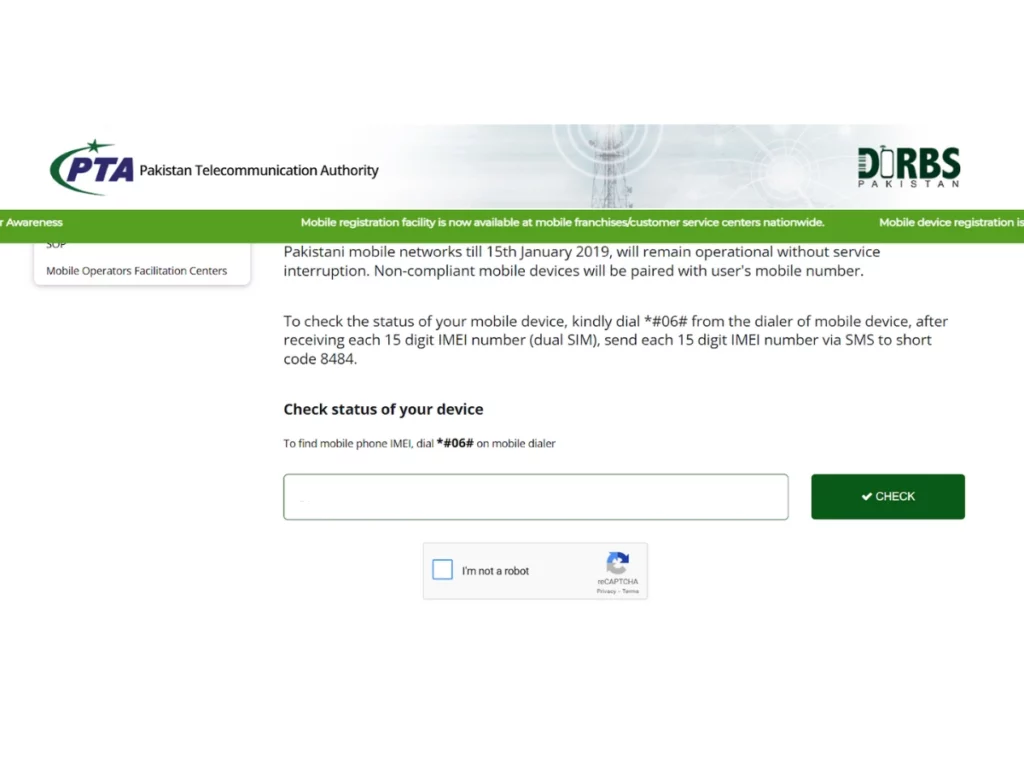

- Visit the DIRBS portal.

- Once you do, you will see the check status of your device section.

- Enter your 15-digit IMEI number.

- Click on the check button.

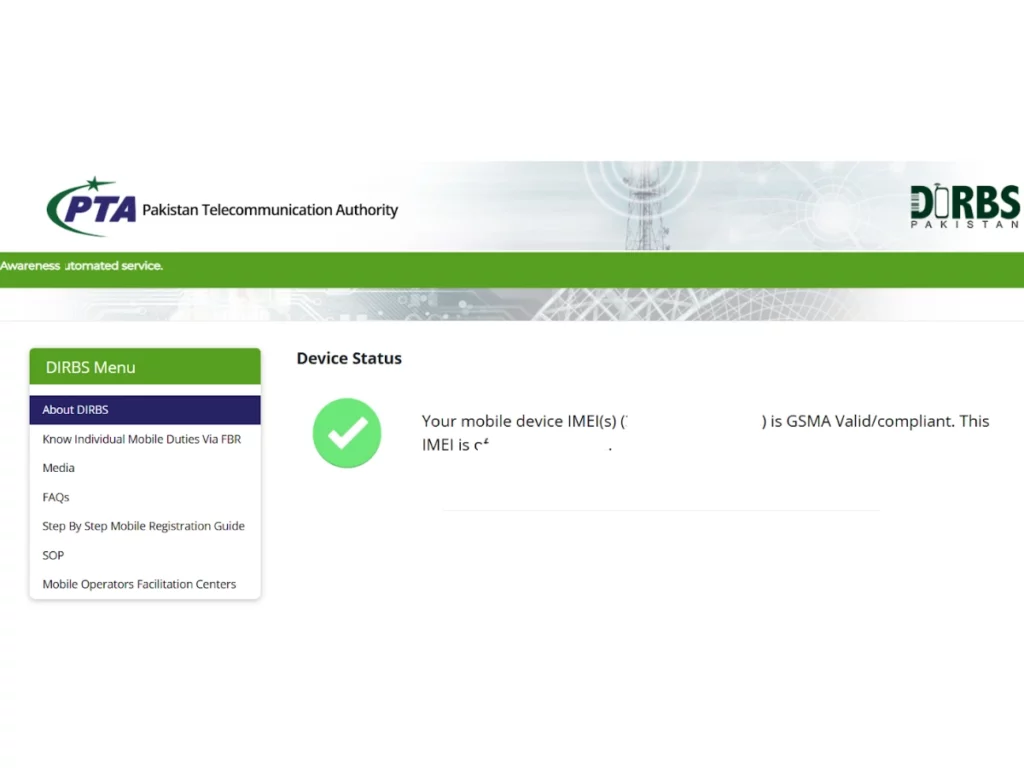

- The status of your device will display on the screen, whether approved or not.

Final Verdict

Having a non-PTA mobile device is illegal in Pakistan. Not only this, the person who has non PTA mobile is always in search of a Wi-Fi network or asking for a hotspot from a friend. To avoid any penalty, it is important to pay the PTA tax on your device, and you can do so by being at home.

In the end, you just need to follow the step-by-step guide on how to pay PTA tax online, as mentioned in the blog. Stay tuned for more informative blogs like this.

FAQs

Dial *#06# on your mobile phone to get the IMEI number.

Open the DIRBS portal online to check the PTA approval status by entering your IMEI code.

It is the 17-digit payment slip ID to make the payments via online banking, ATMs, etc.

Picture Credits: dirbs.pta.gov.pk

Leave a Reply